Can Your Business Afford to Ignore Nature? Startups That Could Save Your Future

Each year, consulting firms and NGOs publish thousands of industry reports. Some are worth skimming. Some are worth reading. A select few are worth re-reading, years after they were published.

PwC and the World Economic Forum’s ‘New Nature Economy’ report, released in January 2020, falls firmly into the latter category.

It’s something we looked back on after COP16, earlier this month. Our key takeaways – all simple (yet, sadly, concerning) truths:

-

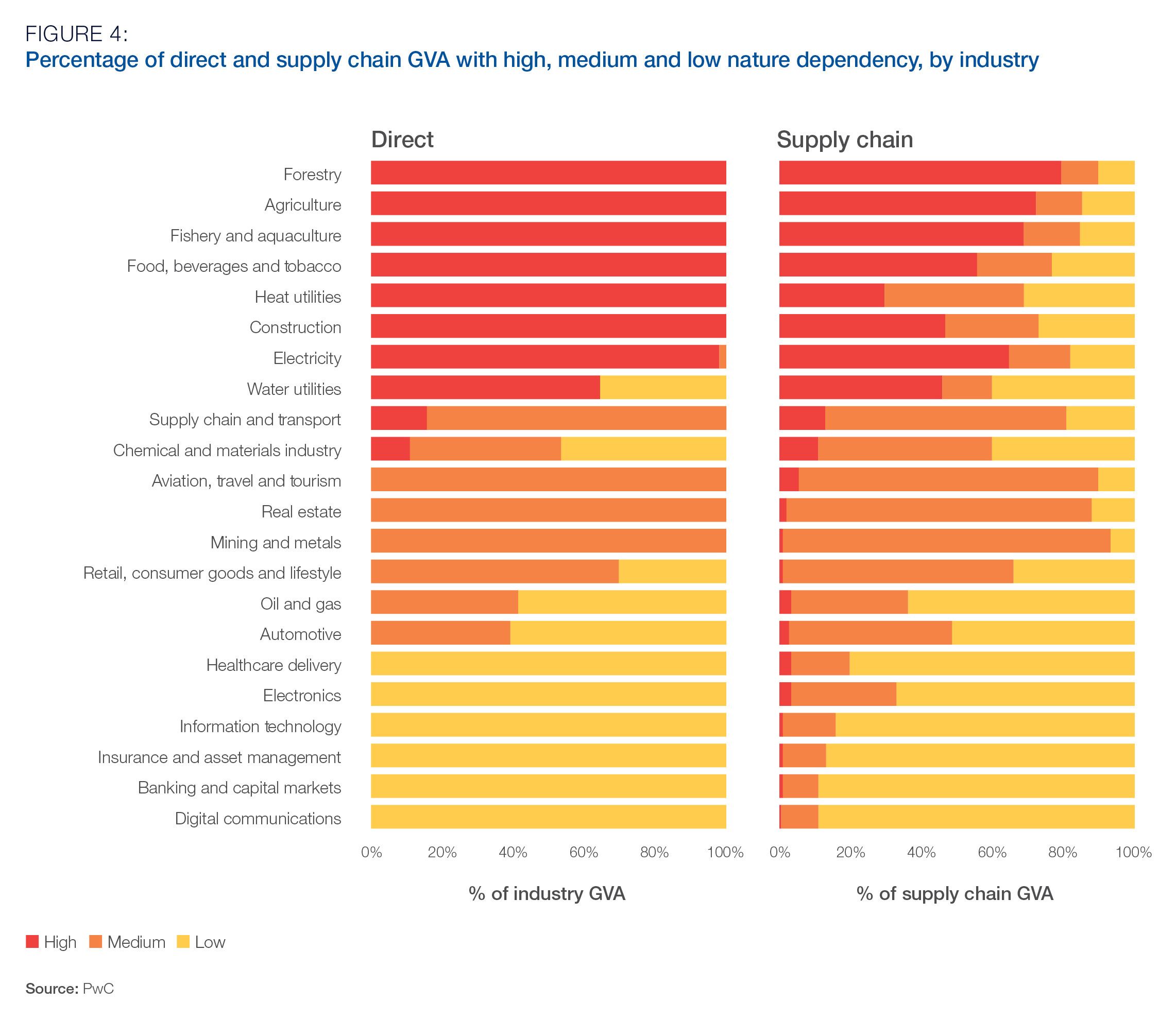

Every sector in the global economy depends on nature, directly or indirectly – for both resources and the ecosystem services that nature provides (like pollination and storm protection). The chart from the report, below, speaks volumes…

-

Without nature, business becomes riskier. Commodities, like crops, will become harder to source. Company infrastructure will face greater threats from floods and fires. Assets could become stranded. The list goes on…

-

In 2018, humans had already caused the loss of “83% of all wild mammals and half of all plants.“

Seven years later, with nature loss continuing at pace, nature risk presents a greater risk to business than ever before.

Source: WEF New Nature Economy Report (2020)

So, as companies plan for 2025, we think it’s worth asking three simple questions:

-

What are your company’s greatest, most existential nature risks?

-

Can you afford not to invest in mitigating them?

-

If the answer is "no, you can’t,” as we imagine it probably is, which investments in nature will have the highest ROI (and best help you to future-proof your business and operations)?

In truth, we don’t have the answers – they vary from business to business – but we do know a number of startups that could help you find them…

Have real estate on the coast?

Then, with sea levels rising, you’d probably like to know its risk of being flooded in years to come, plus how nature can help you to reduce that risk.

Enter Ocean Ledger. Not only can the UK startup calculate your properties’ risk – using satellite and remote sensing data – it can also tell you how best to protect your most vulnerable assets. Having trained its proprietary algorithms on 30 million hectares of coastline data, it can suggest strategic nature- and non-nature-based interventions (i.e. “You should restore mangroves here or install a sea wall there to protect your assets.”)

Founded this year, it’s already run three pilot projects, with NGOs and coastal property developers. Right now, its team is putting the final touches on a cloud-based platform that will allow companies to easily assess their risk, from anywhere in the world. Paige Roepers, Ocean Ledger’s CEO, told us that it’s currently taking sign-ups for an alpha version, due to launch in Q1 of next year. Get in while you can.

Buy a lot of crops?

If you do, you’re probably concerned by the risk of falling yields and rising crop prices in years to come. Thankfully, there may be a solution: according to The Woodland Trust, silvoarable schemes – planting trees in arable fields – can improve average yields by 20% versus mono-cropping. That’s for a range of reasons: trees provide all sorts of services, from improving soil quality to providing habitats for pollinators.

So, why not have your suppliers reach out to DeepRoots, a venture currently helping farmers to adopt agroforestry schemes on arable (and non-arable) farms.

The startup can help farmers to understand their options and build a full business case for tree planting, taking into account both potential revenue and all available grants & subsidies. It’s also developing innovative finance solutions to help farmers initially fund their projects, and plans to help them find buyers for nature credits and any fruit and nuts they might grow (if productive trees are planted).

Right now, the company is running a number of pilot projects. Marek Chalupnik, DeepRoots’ COO, told us it’s keen to speak to more farmers, as well as companies interested in improving the resilience of their supply chains. You can get in touch here.

Need water?

Most companies do, for everything from cooling data centres to running production processes. So, it was cause for concern when experts warned, last March, that global demand for freshwater is on track to outstrip supply by 40% by 2030.

Thankfully, Waterplan can help. The San Francisco-based startup – backed by the likes of YCombinator and the Branson family – is using AI to help companies measure, report and respond to their water risk, across their operations and supply chain.

Its platform centralises data from hundreds of sources, including satellite images and local reports, and uses a proprietary framework to identify high-risk sites i.e. those at risk of water scarcity, flooding, regulatory breaches and other issues.

The startup can then suggest strategic risk mitigation opportunities – like water access and habitat restoration projects – as well as carefully curated project implementation partners.

To date, it’s partnered with dozens of industry leaders, including Amazon, Meta and ABInBev. Mexican tequila brand Patrón has worked with the startup to develop a plan that it hopes will safeguard hundreds of millions of at-risk future dollars.